Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Some homebuyers are sidestepping 6% and 7% mortgage rates by tapping into assumable mortgages. These allow buyers to take over a seller’s existing loan, often locked in at ultralow rates, potentially saving hundreds or even thousands of dollars per month.

While most conventional loans aren’t assumable, loans backed by the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA) are—if certain conditions are met. Fewer than one in six outstanding mortgages are potentially assumable. Though they still represent a small share of total transactions, assumable sales are slowly gaining traction.

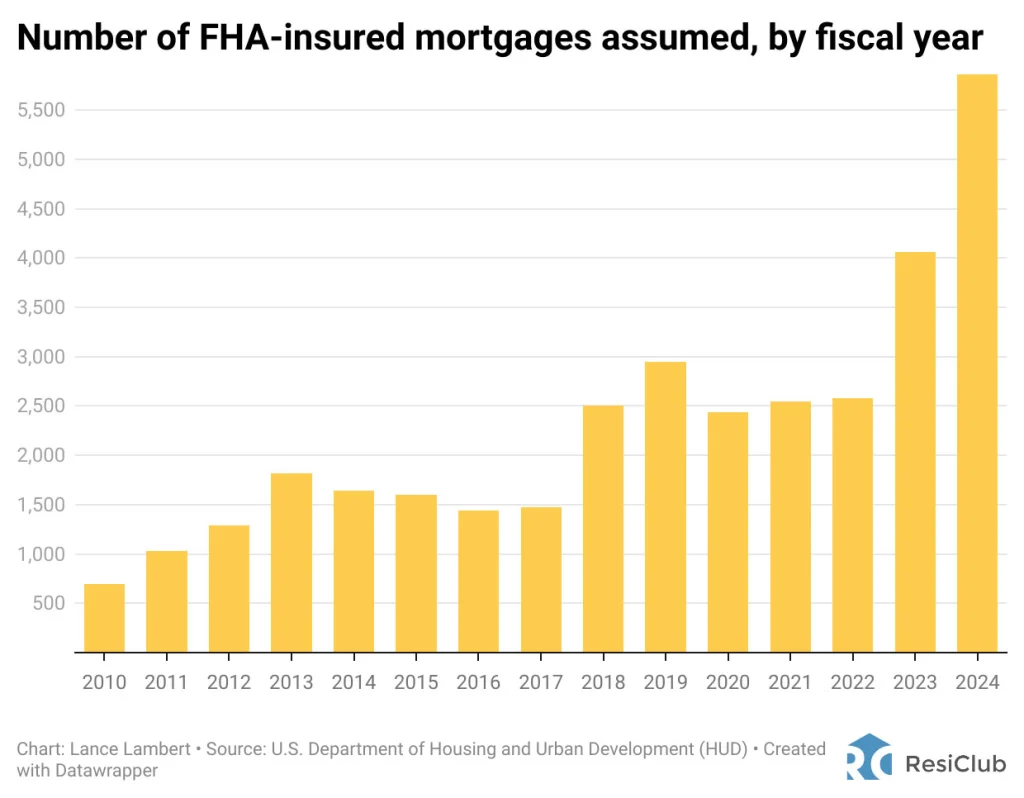

This week, ResiClub heard back from the U.S. Department of Housing and Urban Development (HUD), which provided us the number of FHA-insured mortgages assumed, broken down by fiscal year:

2021 —> 2,549

2022 —> 2,578

2023 —> 4,060

2024 —> 5,861

That’s a 127% increase over the past two years and a 44% increase over the past year.

Based on preliminary data we viewed, ResiClub expects the number of assumed mortgages to climb even higher in 2025.

Of course, there are some real challenges with assumable mortgages:

- Not many assumable mortgages occur because they require buy-in from both the buyer and the seller.

- Many folks in the industry don’t exactly understand the process.

- The buyer must cover the difference between the outstanding mortgage balance and the purchase price of the home. This often requires a substantial down payment. For example, if a seller has a $200,000 mortgage on a home selling for $300,000, the buyer will need to bring $100,000 to the table, on top of assuming the seller’s loan. However, there are options for those who can’t afford such a large up-front payment. Buyers may take on additional debt and get a “blended” rate, which often comes out around 5%.

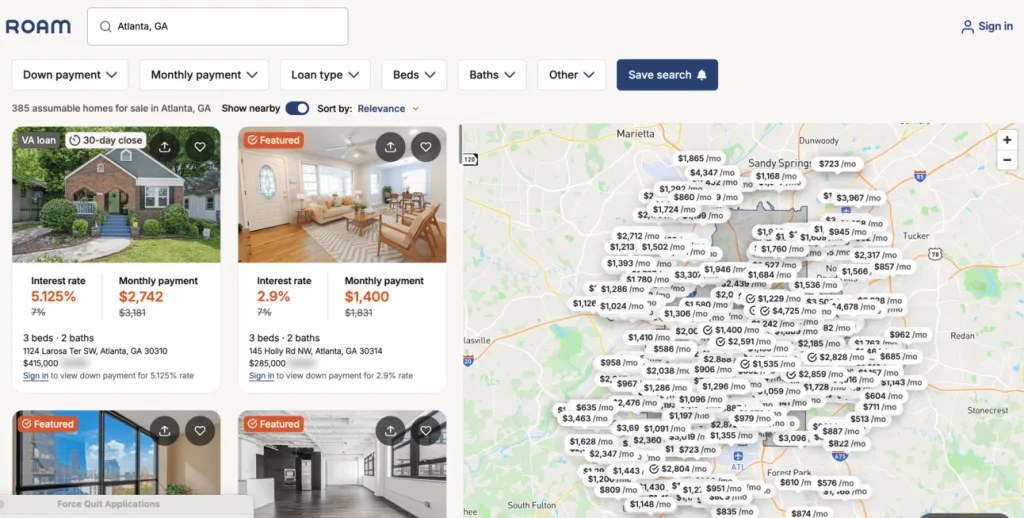

To help make assuming mortgages easier, back in September 2023 Raunaq Singh launched Roam, a real estate portal that resembles Zillow.com or Realtor.com. Only Roam exclusively showcases homes currently for sale with loans eligible to be assumable.

“Most people are shocked by this but there are actually millions of [potentially] assumable loans, meaning the buyer can take over the mortgage and transfer from the seller,” Singh previously told ResiClub. “As we started to look at the problem we realized there would be three key issues. The first was discovery: being able to help consumers find those homes. The second was the transparency throughout the process. And the third problem was coordination: Nobody in the entire transaction experience had experience doing the assumption. If you’re the buyer and you want to assume the mortgage, you have to coordinate with your buyer’s agent, seller, seller’s agent, lender, title, escrow, and closing officer.”

New York-based Roam—which recently raised $11.5 million in a Series A round led by Opendoor cofounder Keith Rabois—not only finds properties with assumable mortgages but also is “effectively your quarterback through that process and coordinating you through the closing,” Singh says.

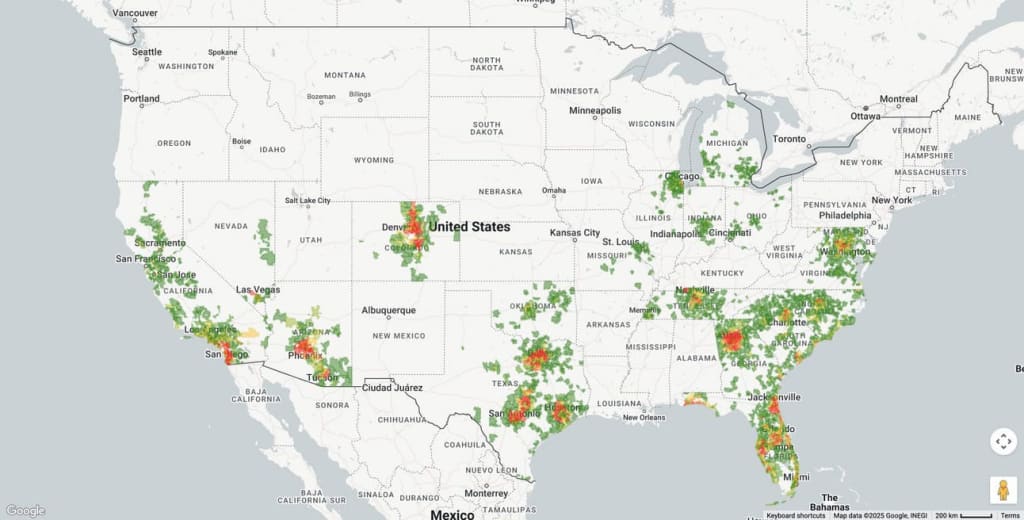

As of today, Roam’s listing website exclusively showcases homes currently for sale with assumable loans in 18 states, including Arizona, California, Colorado, Florida, Georgia, Illinois, Indiana, Maryland, Michigan, Missouri, Nevada, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, and Virginia.

When a seller in those states lists their home for sale, Roam then cross-checks it with proprietary mortgage data. If that mortgage is eligible to be assumed, it’s listed on Roam’s site.

On Roam’s site, you’re asked to fill out a simple questionnaire. Then you’re taken to a portal for your selected market.

I tried it out this week and selected the Atlanta metro market. The site then showed me 385 Atlanta homes for sale right now that have loans eligible to be assumable.

How does Roam make money? Singh tells ResiClub that Roam is free for sellers; the company collects a fee of 1% of the purchase price from the buyer through closing costs.

In Singh’s view, homeowners who hold an assumable mortgage have an advantage if they plan to sell.

“They [the homeowner with an assumable mortgage] don’t know they hold an asset, or a benefit, that can unlock that sale. Early on when we started the company, I’d pull out a list of sellers who had the benefit [a mortgage that could be assumable] but didn’t know and I’d call them and say, ‘Hey, your home has been on the market for 60, 70 days. Did you know you’re burying the lede on being able to sell your home? You’re not advertising the No. 1 benefit you have,’” Singh tells ResiClub. “It’s a $1,500 monthly payment as opposed to a $3,000 monthly payment.”

As active housing inventory for sale continues to rise, and many pockets of the Sun Belt become neutral or buyer’s markets, more sellers are willing to work with buyers to do an assumable sale, Singh says.

“We’re seeing agents advertising Roam on their listings now because they want to differentiate their listing vis-à-vis every other home in the neighborhood because it is the only home that buyers can afford. This usually pulls in an additional three to four buyers per listing, and the median agent who does this goes under contract in 14 to 21 days after advertising their low-rate in their listing,” Singh tells ResiClub.

Singh adds: “An independent group of economists also studied Roam and found that sellers who include their low rate in their home sale netted an additional 5% on their home sales price, which can be a strong negotiating factor for listing agents when they go out to market their home and defend their price point amidst price cuts.”