Imagine this: You are a trader, trading from your phone or laptop on a daily basis. The market looks strong in the morning – you’re tracking Bank Nifty stocks – they’re climbing, and call options are green. You’re picturing profit by the end of the day. You start buying more options, assuming they will give you positive returns.

But as the day wears on, the tide turns. Bank Nifty starts slipping, your options start bleeding red, and the profit you imagined fades into loss. You have no idea what just happened. What led to the sudden drop? You’re not alone – there are millions of other traders like you sitting on heavy losses.

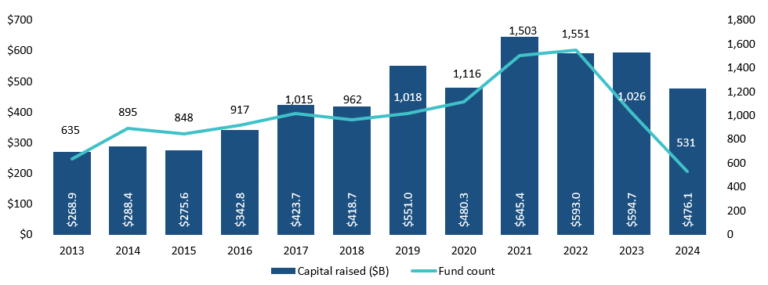

Retail investors in India lost nearly ₹1.06 lakh crore in Futures & Options (F&O) trading – a 41% jump from ₹74,812 crore in FY 2023. Put simply, out of every ten retail investors trading in the F&O segment, nine ended up losing money. And in this story, one of the big winners behind the headline was Jane Street, a global algo-trading powerhouse.

Before we dive into the case, let’s take a moment to understand derivatives – and what futures and options are:

Derivatives are financial contracts whose value is based on some underlying asset – this could be a stock, gold, or any underlying securities or commodities. In the F&O world, you trade in:

- Futures – an agreement to buy or sell later at a set price on a future date

- Options – the right, but not the obligation, to buy or sell at a set price on or before a future date. For this right, you pay a small fee called a premium

Many traders prefer options since they require less upfront capital and can limit losses to the premium paid.

When you purchase an option, the premium you pay has two components:

- Intrinsic Value – the worth of your option if you exercised it today

- Time Value – the extra amount you pay for the possibility that the option’s value might increase before it expires.

Options also come in two types:

- Call Options – betting that prices will rise

- Put Options – betting that prices will fall

The world of F&O trading might sound simple on the surface, but it’s far more complex. Now that we’ve covered the basics, let’s dive into the case.

What is Jane Street?

Jane Street is a global trading company that largely uses computer algorithms for high-frequency trading (HFT) of financial assets. This allows them to execute trades at a rapid rate, often in milliseconds, and on a large scale. Their success is attributed to advanced computing, sophisticated mathematical models, and statistical analyses, which are developed by highly skilled individuals, often hired from top Ivy League colleges and top IITs in India at hefty packages.

In April 2024, Jane Street filed a lawsuit against its rival Millennium Management, alleging that Millennium had poached two of its former employees – Douglas Schadewald and Daniel Spottiswood – who helped Jane Street develop a highly profitable algorithm in 2018, which was so lucrative it needed to be kept a secret. Jane Street had signed a confidential and intellectual property agreement with them in December 2023. However, both of them left the firm to join Millennium Management, which allegedly led to Millennium gaining access to Jane Street’s secret strategy.

Initially, Jane Street’s lawsuit did not disclose the specifics of its strategy, nor the country to which it was applied, fearing that it would become public. However, during the proceedings, the Millennium lawyers inadvertently named India as the country involved, revealing that this strategy was deployed in the Indian Public markets, so much so that Indian option trading has been a goldmine for the firm. It was also disclosed that Jane Street had earned $1 billion in 2023 using this strategy.

But later? Despite the dramatic revelations during the legal proceedings, Jane Street and Millennium settled the case in December 2024, through the settlement was made out of public eyes, behind the headlines. Now this legal battle and the accidental revelation caught the attention of the Securities and Exchange Board of India (SEBI), which later launched its investigation into Jane Street’s activity in India.

SEBI’s Discovery and Investigation

SEBI launched a thorough investigation into Jane Street’s activities in India, covering the period between January 2023 and March 2025, with an aim to uncover the specific strategy deployed by the firm. The investigation confirmed that Jane Street has earned approximately ₹5,000 crores from its activities in India. According to SEBI’s report, the market manipulation was constituted under two segments – “Intraday Index Manipulation” and “Extended Marking the Close”

- Intraday Index Manipulation –

To raise the index price in the morning, Jane Street would aggressively purchase sizable amounts of Bank Nifty stocks and futures. They would sell those holdings later in the day, which would cause the index to plummet, enabling them to profit from earlier bearish options positions. This led to fictitious price fluctuations that deceived ordinary traders

- Extended Marking the Close –

The volume-weighted average price (VWAP), which determines option settlement values, was pulled down by Jane Street’s heavy selling throughout the final hour of expiry day trading, rather than just last-minute trades. This increased profits on their options positions at expiration by manipulating the official closing price in their favour

At its core, the manipulation involved Jane Street’s Indian entities aggressively buying Bank Nifty Index stocks – such as HDFC Bank, Kotak Bank, or SBI – in the cash market during morning hours to artificially drive up the index’s price. Simultaneously, Jane Street’s international entities, like the one based in Hong Kong, would bet on the derivatives market (Futures and Options) that the Bank Nifty would fall.

For instance, on January 17, 2024, the Bank Nifty index opened at 46,573.95, a significant decline from the previous close of 48,125.10. According to media reports, the market’s apparent dissatisfaction with HDFC Bank’s results following the market close on January 16, 2024, may be the cause of this decline (table below summarises the same). By purchasing stocks and futures valued at ₹4,500 crores, Jane Street carried out this strategy and made an incredible ₹734 crores in a single day.

Why just Bank Nifty stocks and derivatives? This particular index is calculated based on the prices of twelve major banking stocks in India, making it highly liquid and popular among retail traders for derivatives trading. By manipulating these key stocks, Jane Street could directly influence the Bank Nifty index level, which in turn can command the settlement prices for index options.

This entire game was based on a pump and dump strategy, rather than a genuine reflection of demand and supply. This practice has harmed the retail traders and market sentiment as a whole, who, unaware of the manipulation, may purchase call options, thinking that the market would keep rising, but Jane Street promptly sold its holdings, which caused the index to decline.

The Aftermath

In February 2025, SEBI issued a formal letter to the firm, explicitly banning the firm from trading in India and also demanding that it must deposit all the money earned from manipulation. On 11th July, Jane Street deposited the full ₹5000 crores that were identified as profits from manipulation. Ten days later, the ban on Jane Street was lifted, which effectively “solved” Jane Street’s immediate problem with the regulator. However, there are broader implications to this case and unresolved questions –

- Timings of Intervention – Despite the actions, why did SEBI wait until July to act against Jane Street?

- The incident brought to light SEBI’s acknowledgement that 91% of retail traders experience losses when trading derivatives. This figure highlights the ongoing problem of speculative trading in India, as millions of people continue to trade in the hopes of making large profits

- The effectiveness of SEBI’s initiatives, such as risk meters, improved surveillance, and public awareness campaigns, is called into question, particularly in light of the widespread influence that portrays options trading as “child’s play.” The general perception is still that “Indians are crazy about options trading,” as evidenced by the country’s 99.6% market share in options trading and the 400-fold increase in derivatives volume over cash market volume. (Figure above shows the Indian derivative market share across major economies globally)

Written and Edited by – Mir Irfan Ali

The post From Wall Street Complex Algorithms to Dalal Street Drama appeared first on The Economic Transcript.