Meet Nissan’s “cost-cutting czar”

In a new report published by Automotive News, a Nissan exec who the publication dubs the “cost-cutting czar” is leading the charge to find ways to save the embattled automaker money. Tatsuzo Tomita, who was hired in April as the company’s Chief of Total Delivered Cost Transformation, told the industry publication that, over the course of three months, he and a special team of 3,000 employees identified more than 4,000 ways across the company’s operations to wring out every last drop of savings. Some of these will launch very soon.

“Taking action is now what matters. We are shifting to execution,” Tomita told AutoNews. “We need to improve the profit of each product, otherwise we won’t be able to enjoy a sustainable business.”

Nissan

The cuts run down to the supplier level

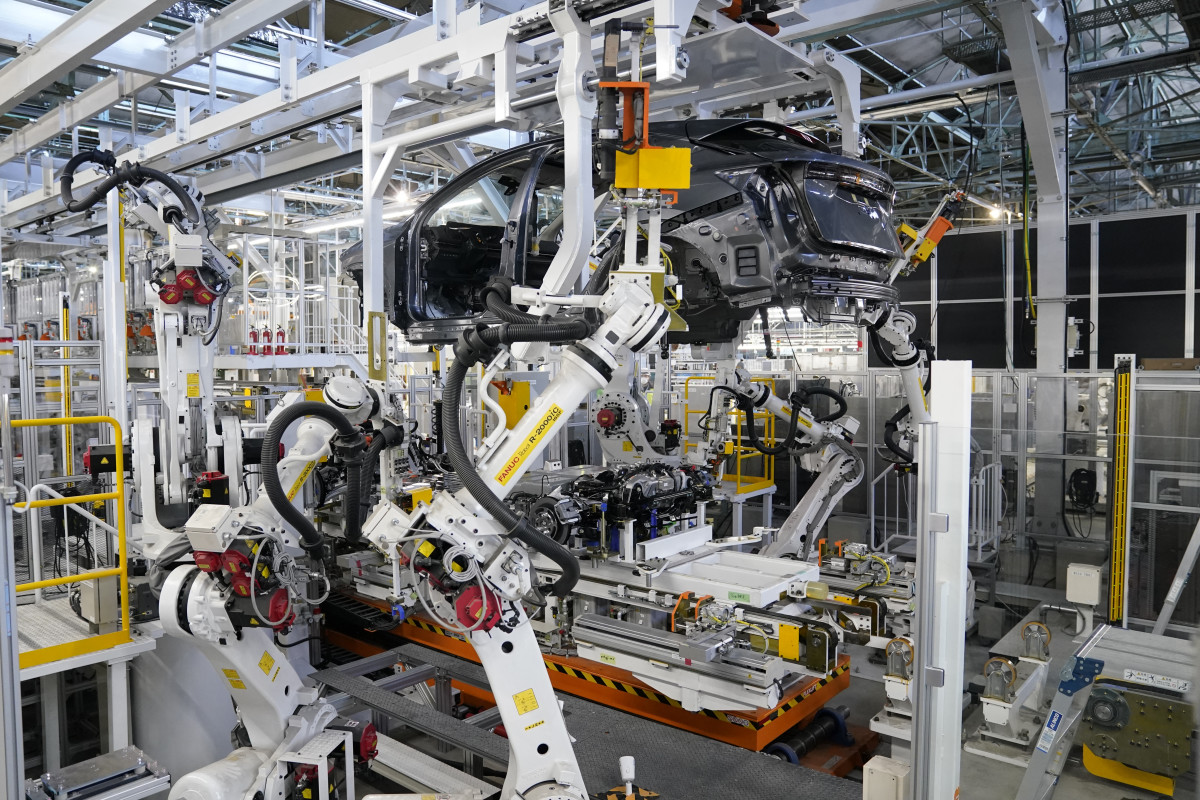

To help Nissan reduce costs, Tomita’s team is reviewing various aspects of the company’s operations, including Nissan’s internal standards and specifications, as well as those of its suppliers. The team is also taking a close look at the diversity of parts and colors used in vehicles, benchmarking and examining ways it can use Chinese-origin parts, and scrutinizing the number of suppliers it takes on for each component.

Of the 4,000 ideas that Tomita’s special team has conjured up, about 1,600 have been deemed feasible so far. Most of these ideas have to do with Nissan’s cars at a supplier and manufacturing level, as they pertain to the parts and materials they deem appropriate to use.

For example, Tomita’s team found that reducing the variety of headrests Nissan installs onto its seats would help one of its suppliers run more efficiently, as the wide range of parts needed for Nissan’s headrests covered the size of two tennis courts and required workers to walk 30,000 steps per day while picking out parts.

Nissan

The team also found that because the glass Nissan uses in its vehicles blocks ultraviolet (UV) light, Nissan wouldn’t have to use special dyes that it had used to prevent the seat fabric from fading in the sun. Likewise, they also found that Nissan’s headlight specifications called for headlights that were much stronger than the rest of the industry, allowing it to forgo bespoke Nissan-specific parts and switch to cheaper standardized components that other automakers used. Additionally, Nissan is exploring ways to pre-assemble certain components before they arrive at the factory, aiming to reduce costs associated with logistics.

Getty Images

“We don’t say yes to every idea,” says Tomita

Though it plans to increase its use of Chinese-origin parts and its business with Chinese parts suppliers as part of its efforts to refresh and scrutinize every last way Nissan can save a dime, Tomita told AutoNews that it won’t go to extremes to cut its suppliers or cheapen Nissan cars.

Tomita added that more than half of the over 4,000 ideas that his team came up with were rejected. He also emphasized that any suggestion related to any component or content that Nissan’s potential customers could see is thoroughly reviewed for consumer trends, preferences, and feedback before approval.

However, Tomita did not discount the involvement of Nissan’s suppliers, as they have been a valuable mouthpiece for such ideas. He noted that 80% of the 4,000 ideas that Tomita’s team came up with were through some consultation with suppliers, and about 20% came straight from the suppliers themselves.

Nissan

Tomita told AutoNews that this problem began when it pursued sales growth through production scale, as its lineup inflated to the point where it attempted to capture every possible automotive niche. At the same time, Nissan’s internal departments grew larger and less communicative with each other, which led the company to bleed money and spend way too much time developing new models. The bloat then became a liability and a problem when its strategy didn’t translate to sales.

“We made too many price variations and too many Nissan-unique specifications,” Tomita said. “And in each of the silos, each division came up with its own standards or processes and key performance indicators. Now, in this rapidly changing environment, we have not been able to make swift decisions. So that is the biggest challenge Nissan has been facing.”

Final thoughts

This report follows a day after another report, in which Nissan Global Design Chief Alfonso Albaisa confirmed that the automaker will close its design studios in San Diego, CA, and São Paulo, Brazil, in 2026, while scaling back design operations in Japan and the UK.

However, while Nissan seeks to drastically reduce headcount, it also aims to preserve its most productive and efficient staff members who can help the company quickly bring new vehicles to market. Its ultimate goal is to streamline its product development cycle to just 30 months, a hefty goal from the current timeline of 52 months.

“We are pushing to do everything we can because we need to improve the performance of the company,” Espinosa said. “The only way of becoming better at coping with these things is to be quick, and this is what we are working on now.”