Are you ready to hand over control of your portfolio to artificial intelligence? Fahad Hassan, cofounder and CEO of AI-powered wealth management platform Range, thinks you should seriously consider it.

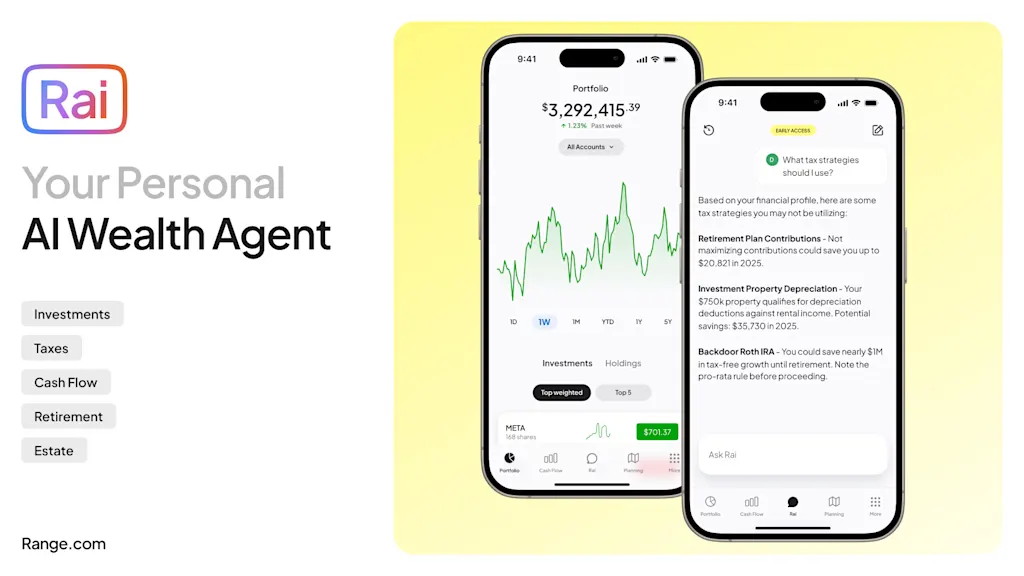

Hassan’s five-year-old company is introducing “Rai,” a new proprietary AI wealth advisor that, he believes, will give a huge swath of American households access to the sophisticated advice and planning that was traditionally only accessible to those with sky-high net worths.

“Rai is the first product, the first AI agent, that we believe can do the work of human advisors just as well, if not better,” Hassan says.

And while plenty of other fintech companies have rolled out or otherwise introduced AI tools to help with wealth planning in recent years, Hassan says that Rai is different for a couple of key reasons.

First, Rai has access to more and better data than other tools, Hassan says. Range’s customers who use Rai can connect dozens of accounts (real estate information, retirement and investments, restricted or private stock holdings, etc.). That gives the tool a broader picture of an individual’s financial status.

Second, Rai has been rigorously trained against regulatory standards—that is, it’s designed to pass the sorts of exams that human advisors would need to pass, which are administered by organizations like the Financial Industry Regulatory Authority (FINRA).

Not only that, but that level of sophistication also allows Rai to continuously self-improve and learn as it goes.

But Hassan says that Rai goes yet another step further. “It can take action against your money, such as file your taxes, develop an estate plan, and more,” he says.

Those sorts of actions, which would traditionally require that customers enlist an accountant or an attorney, can now be done in-house by Rai, potentially saving users huge amounts of money.

“We can provide hundreds of thousands of dollars in value in 10 seconds,” Hassan says. “You don’t need to wait for a human anymore.”

More Waymo than Uber?

If this sounds something like “Robinhood for wealth advisories,” Hassan says that’s not quite the goal.

“We think of this as Waymo, not Uber,” he adds.

Uber democratized access to ride-sharing and connected drivers with riders. It may be more helpful to think of Rai as connecting you with a ride, and doing the driving.

It’s a one-stop shop, and you can access it without the relationship-building process—country club lunches, tee times, or whatnot—that human advisors traditionally use to build their client bases.

Headquartered in McLean, Virginia, Range most recently raised $28 million in a November 2024 round led by Cathay Innovation, 10X Group, Brave Capital, Gaingels, and others, according to data from PitchBook, for a total raised to date of $40 million.

Of course, whether or not people adopt Rai, like they did Robinhood or other financial tools, has yet to be seen. If they do, the tool could potentially shake up a lucrative yet traditionally walled-off branch of financial services for more households. It’s the speed and granularity that the company’s leadership believes will make a difference.

“Rai analyzes your complete financial picture in seconds—every account, every asset, every opportunity,” said David Cusatis, Range’s cofounder and CTO, in a statement. “We built proprietary technology to deliver recommendations that no human advisor could match at this speed and scale.”