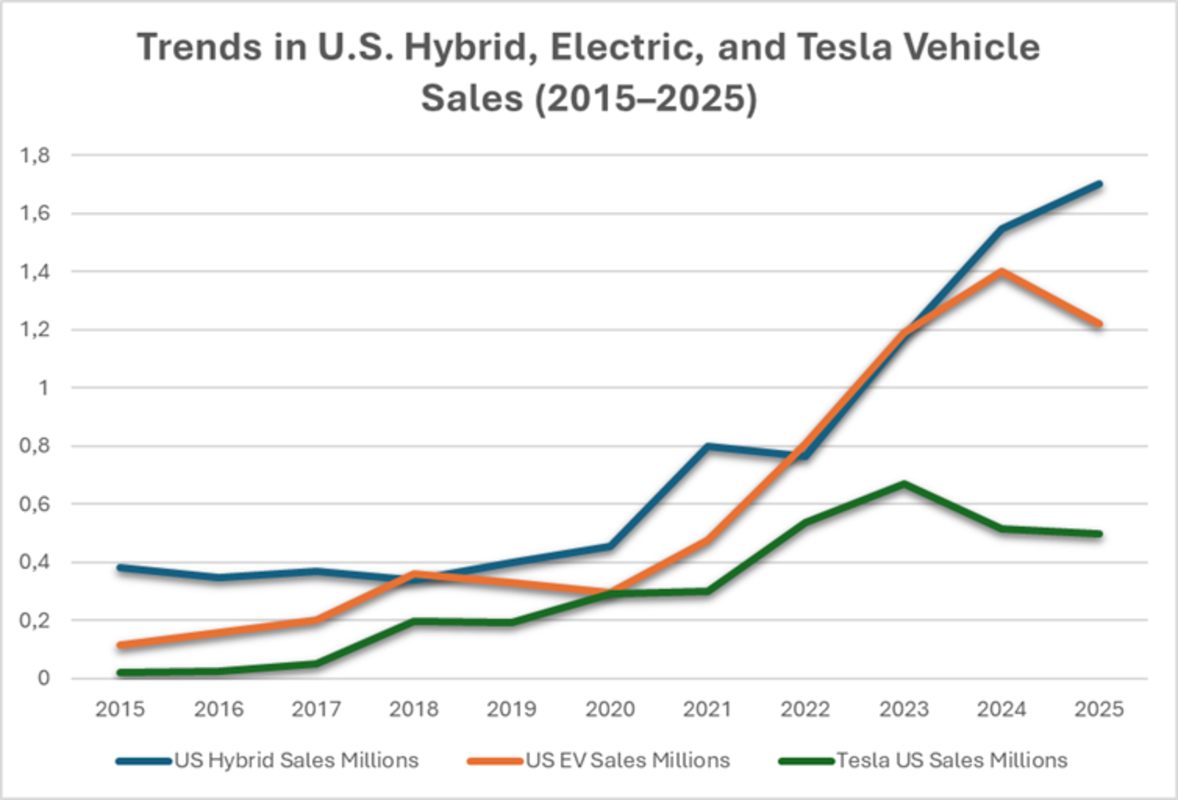

“Hybrid sales climbed from 384,400 units in 2015 to about 1.7 million in 2025, while EVs rose from 116,548 to roughly 1.22 million—and many buyers point to painful pump prices as the trigger.”

You’d drop that line over a tailgate breakfast, coffee in hand and the scent of burnt rubber still lingering. Those numbers tell a story: when gas tops $4 a gallon, drivers rethink old routines and plug in instead of filling up.

Morning Routine Meets Pump Shock

Imagine rolling out before dawn, wiping dew off the windshield, then pausing at a red light while your mind ticks off last night’s gas bill. In 2015, hybrids barely hit 2% of U.S. light-vehicle sales; EVs under 1%. By 2025, hybrids grab over 10% and EVs near 8% of the market. High pump prices accelerate that shift. When a family road trip means $100 at the pump, the promise of home charging and better mpg cuts through skepticism. You still hear that engine rumble in a hybrid, but fewer fill-ups feel like a win. And if you drive an EV, you watch the charging status as closely as a fuel gauge—only now you pay for electricity, not gallons.

Figure 1: U.S. hybrid vehicle sales have soared from under 0.4 million in 2015 to an estimated 1.7 million in 2025, outpacing electric vehicles, which climbed from about 0.12 million to over 1.2 million in the same period.

Hybrid’s Practical Appeal

Hybrids ease the pain at the pump. Modern systems blend gas engine and electric motor so smoothly you barely notice the handoff at low speeds. Owners sacrifice a bit of trunk space for batteries but gain fewer stops at the station. Hybrid share jumped from about 3% in 2020—despite the pandemic slump—to over 10% by 2025. When daily commutes cost less per mile, you feel it at the pump and in your wallet. Torque-vectoring software smooths acceleration, so the drive stays engaging even as fuel bills shrink.

EV Charging and Cost Trade-Offs

Charging adds new rituals. A home Level 2 charger nets about 30 miles of range per hour. That works overnight but demands planning on long trips. Public fast chargers ease range worries but can cost as much per kWh as a premium coffee habit. Still, with gas averaging $3.50–$4.00 a gallon in recent years, many drivers do the math and plug in. EV sales jumped from 0.2 million in 2017 to over 1.2 million in 2025. Drivers map charging stops like old-timers tracked diners. The smell of gasoline fades; you listen for the hum of electricity flowing.

Tesla

Tesla’s U.S. Role

Tesla once dominated U.S. EV sales, peaking near 670,000 in 2023, then settling around 130,000 in Q1 2025, projected to be around 500K by year-end. High gas prices boosted EV demand, but rising competition and charging networks spread the load. Tesla owners talk firmware updates like engine tweaks. Preconditioning batteries before highway runs joins oil-change chat in the garage. Yet buyers still weigh charging convenience against pump pain: if filling up costs $70 for a long haul, even a slow public charger seems tempting.

Weekend Garage and Wallet Check

Weekends mean garage time: swapping air filters on a hybrid or checking charging cables for an EV. You compare mpg and charging costs while swapping coffee stains in cupholders for charging adapters. Enthusiasts track sales data like horsepower figures—because those numbers reflect the shifting landscape at the pump. Maintenance talk shifts from oil changes to battery health and tire wear under instant torque.

Final Thought

High pump prices push drivers toward hybrids and EVs, but car culture remains about the drive itself: the thrill of acceleration, the scent of tire smoke at a launch, the quiet hum of electric torque at dawn. Charging stops may replace quick fill-ups, but the ritual of travel endures. These sales numbers show more drivers joining new routines without abandoning the pleasures of the road. The journey changes, but the ride still matters.