A Ban that Shaped Global Strategy

When the European Union (EU) announced in 2022 that all new cars and vans sold after 2035 must achieve a 100 percent reduction in carbon dioxide emissions, the rule was interpreted as an eventual end to the internal combustion engine.

That single target affected product plans not only for European manufacturers but also for companies outside the region that rely on exporting to and from the EU. Automakers began redirecting their investment toward electric vehicles, and suppliers aligned their development strategies accordingly. The regulation effectively set a global benchmark, since many brands design their lineups with European compliance in mind. The policy’s impact reached far beyond Europe’s borders, influencing long-term planning in North America and Asia as well.

Initially, the European Commission scheduled a formal review of this zero-emission mandate for 2026. However, political pressure from carmakers and several member states has led the Commission to move the review forward. Instead of waiting until next year, EU officials will revisit the target before the end of 2025, opening the door to possible adjustments much earlier than expected.

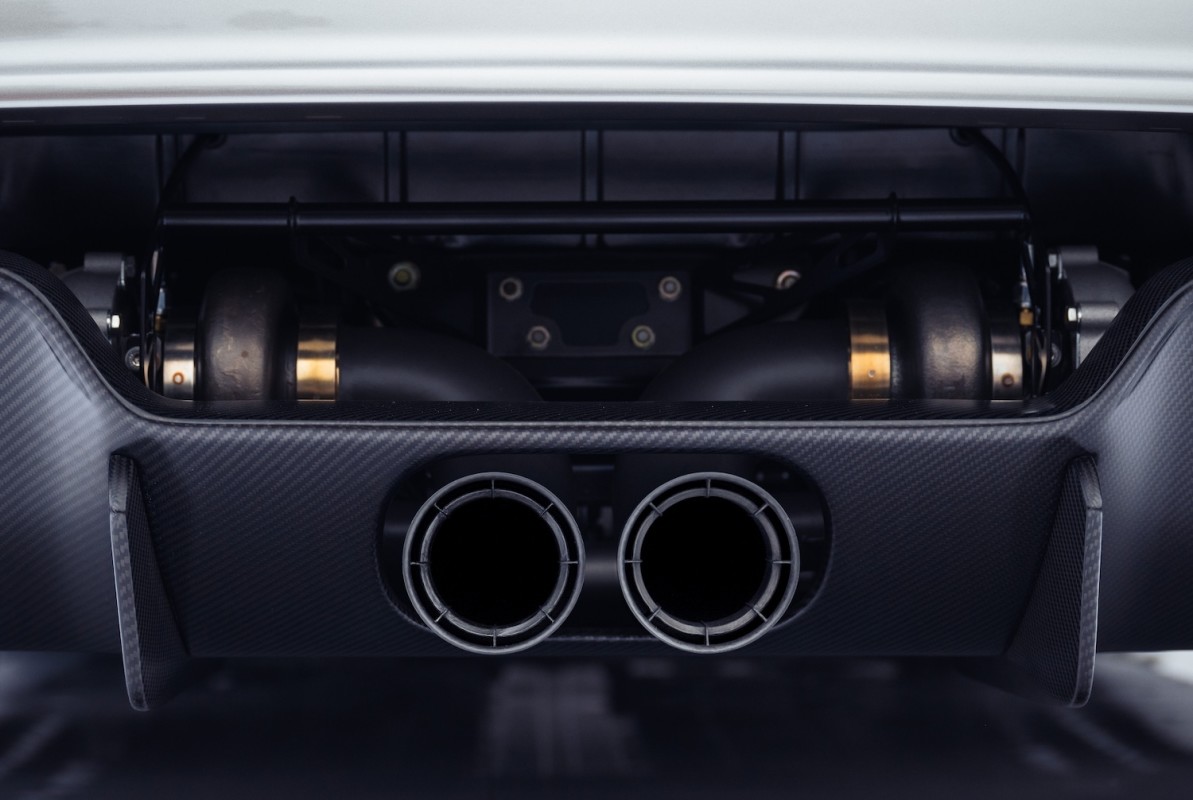

Gunther Werks

The EU Will Review the Ban Sooner Than Expected

According to Reuters, European Commission President Ursula von der Leyen met with automotive executives in Brussels last week for what was described as a strategic dialogue that lasted several hours. Another round of discussions is planned before December. The review will assess whether a total shift to battery-electric vehicles is realistic by 2035, considering slower-than-expected growth in charging infrastructure and weaker consumer demand in certain parts of the continent.

Possible policy changes include allowing new vehicles with internal combustion engines to remain on sale if they run exclusively on carbon-neutral fuels such as biofuels or synthetic e-fuels. Plug-in hybrids and electric vehicles with small gasoline range extenders are also under consideration. Vans will receive specific attention because electric versions make up only 8.5 percent of EU van sales, roughly half the share of electric passenger cars.

Mercedes-Benz

Automakers Have Split Opinions About the Ban

The review will unfold alongside proposals to decarbonize corporate fleets, which represent about 60 percent of all new vehicle registrations in the EU. The Commission is also considering a new regulatory category for small electric cars that could benefit from lower tax rates and extra credits toward emissions targets. Further measures aim to increase local content for batteries and critical components, and to establish conditions for foreign investment, particularly from China, to avoid the simple final assembly of imported parts.

Naturally, automakers have split opinions about the combustion engine ban. Volkswagen is all for the zero-emission goal but seeks more time and flexibility. BMW and Mercedes claim that a strict ban could lead to job losses and could affect the economy, while Volvo, Polestar, and Kia are okay with the original deadline. The Commission has not detailed any revisions, but the accelerated timetable means Europe’s stance on combustion engines will be clearer well before the decade’s end.