Demand from hyperscalers and cloud service providers fueled record leasing volume in the first quarter of 2025 amid widespread adoption of artificial intelligence and persistent power constraints, CBRE said in its Global Data Center Trends report.

Strong demand and limited availability in core markets led hyperscalers to turn to secondary markets, creating new hotspots like Richmond, VA, Santiago, Chile and Mumbai, India. The global data center vacancy rate declined by 2.1 percentage points year-over-year to a record low 6.6% in Q1.

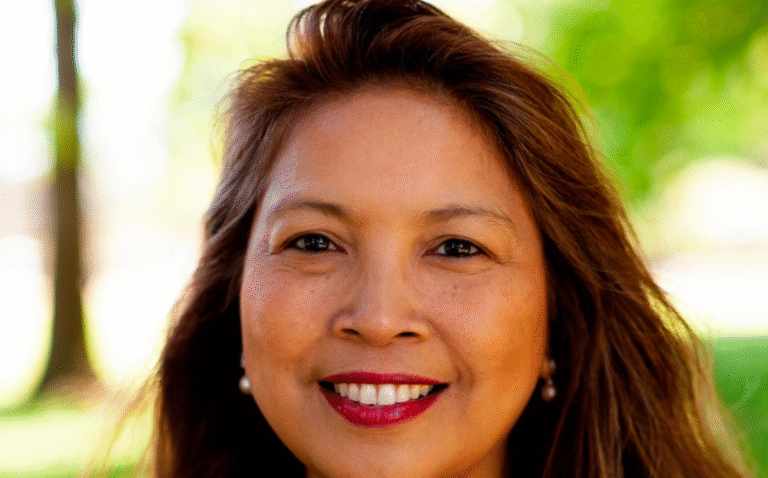

“Rising demand from AI and hyperscale users is shrinking vacancy and operators with available capacity in key markets are commanding premium rates,” said Pat Lynch, executive managing director for CBRE’s Data Center Solutions. “As supply tightens in core markets, we’re seeing rapid growth and investor interest in emerging markets, which are becoming central to global deployment strategies.”

North America had the largest year-over-year inventory increase in Q1 2025 (43%), as well as the lowest average vacancy (2.3%). Northern Virginia remains the largest North American data center market, followed by Atlanta and Phoenix, which surpassed Dallas and Silicon Valley for the first time.

The post Hyperscalers, Cloud Service Providers Push Data Center Vacancy to New Lows appeared first on Connect CRE.