A resilient bond market is central to a country’s ability to achieve sustainable growth while maintaining financial stability. Bonds provide governments with a stable source of financing, corporations with a means of raising long-term capital, and investors with reliable income streams. A resilient bond market facilitates the efficient allocation of savings, smooths the transmission of interest rates, and cushions the financial system against external shocks. Conversely, a fragile market can magnify volatility, restrict financing, and undermine the effectiveness of monetary and fiscal policy. For India, which is pursuing ambitious infrastructure expansion and deeper financial integration, bond market resilience is a vital priority.

Overview of India’s current Bond market

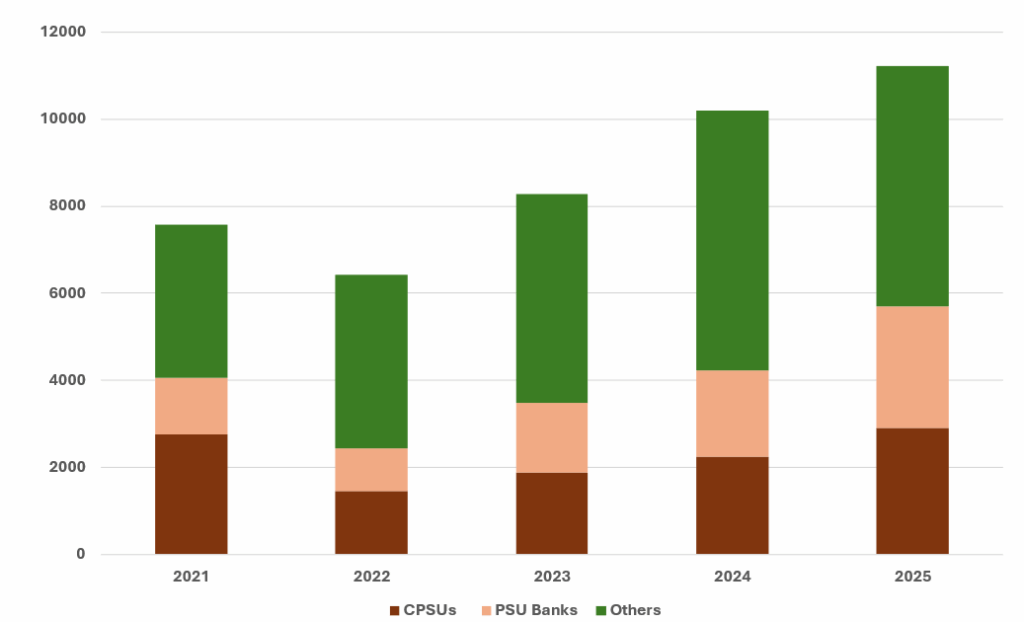

India’s bond market has expanded significantly in recent years, though it remains smaller than those in developed economies. As of FY2024–25, the corporate bond market stood at approximately ₹53.63 lakh crore (around USD 640 billion), marking a 13.4% year-on-year increase. Corporate bond issuance has risen from about ₹4.4 trillion in FY2015 to a projected ₹11.2 trillion in FY2025, reflecting a compound annual growth rate of nearly 10%. Despite this progress, India’s corporate bond market accounts for only 16–18% of GDP, compared to far higher ratios in advanced markets.

Institutional investors, including banks, insurance companies, mutual funds, and pension funds, dominate market participation. Retail investors account for less than 4% of holdings, reflecting low awareness, higher minimum investment requirements, and the perception of bonds as complex products. On the external front, foreign portfolio investors (FPIs) are increasingly important, especially in government securities and high-rated corporate bonds. Their activity is shaped by regulatory ceilings, investment routes, and currency hedging costs.

India’s bond market has solid primary and secondary systems, though accessibility and liquidity challenges remain. The RBI manages auctions for G-Secs, T-bills, and SDLs, with its Retail Direct Scheme enabling individuals to invest directly. On the secondary side, NDS-OM supports G-Sec trading, while corporate bonds trade mostly OTC. SEBI’s Online Bond Platform Providers (OBPPs) aim to boost transparency and retail access. Settlement is handled by CCIL, with SEBI and rating agencies overseeing disclosures and credit frameworks.

Shortcomings under the Bond market

Despite its growth, India’s bond market faces persistent weaknesses.

- Liquidity constraints remain a major issue. Secondary trading volumes are thin for most corporate bonds, with only a handful of AAA-rated issuances enjoying deep liquidity. As a result, price discovery is often opaque, discouraging participation.

- Retail participation is limited. Minimum ticket sizes, tax disadvantages compared with equities, and lack of financial literacy discourage households from entering the market.

- Regulatory complexity for FPIs has historically constrained inflows. Before the 2025 reforms, FPIs faced restrictions on concentration, residual maturities, and short-term exposures.

- Credit risk and information asymmetry persist, especially for lower-rated issuers. While most issuance is concentrated among highly rated entities, small firms face challenges raising funds due to limited investor trust and uneven rating quality.

Reforms Implemented

To address these issues, Indian regulators and policymakers have implemented significant reforms.

- The RBI’s Retail Direct Scheme (2021) has been a major step toward democratising bond ownership by allowing individuals to invest directly in G-Secs without intermediaries.

- SEBI has introduced digital market infrastructure through OBPPs, making bonds accessible like equities. It has also floated proposals to simplify compliance norms for FPIs investing exclusively in government securities, reducing disclosure and Know Your Customer (KYC) requirements.

- The RBI in 2025 removed the short-term investment limit and concentration limit for FPIs in corporate bonds, while setting the overall cap at ₹8.22 lakh crore for April–September and ₹8.80 lakh crore for October–March of FY 2025-26. This step is expected to attract greater foreign capital.

- The Ministry of Finance has worked to include Indian G-Secs in global bond indices. This move could channel billions of dollars in passive foreign investment and improve India’s weight in international portfolios. Together, these reforms are gradually enhancing liquidity, broadening participation, and anchoring resilience.

Strategie for Future Planning

Looking ahead, two major strategies can strengthen India’s bond market further – retail participation and internationalisation.

Boosting retail participation requires lower investment thresholds, fractional bond options, tax incentives, and stronger investor education, with OBPPs on mobile platforms expanding access. Internationally, relaxing FPI rules, enabling FAR access, and global index inclusion could attract inflows. To sustain them, India must enhance settlement systems, currency-hedging tools, and legal certainty for investors.

Bond market resilience needs strong risk management. Regulators stress-test portfolios against rate hikes, inflation, and defaults. SEBI mandates liquidity checks and stress testing for bond funds, while exploring market makers for thinly traded bonds. Credit risks demand better rating agency accountability, stricter disclosures, and stronger credit enhancement mechanisms.

Operational resilience, including robust digital settlement and clearing infrastructure, is also central, while fiscal discipline ensures sovereign debt remains credible and does not crowd out private credit markets. India’s bond market outlook is positive. Record corporate bond issuance of ₹10 trillion in 2025 reflects growing reliance on bond financing amid falling interest rates and rising capital expenditure needs. Retail participation is expected to rise as OBPPs gain traction and minimum denominations fall.

Foreign inflows are likely to strengthen with index inclusion and regulatory easing, though global volatility will expose India to capital flow risks. At the same time, the development of new products (such as green bonds and ESG instruments) will broaden the market and align it with global sustainability trends. Over the long term, India’s bond market can transition from a predominantly institutional and government-driven system to a deep, liquid, and diversified market, capable of supporting rapid economic growth while withstanding shocks.

Conclusion

India’s ₹53 lakh crore bond market is vital for growth and stability, offering funding and anchoring monetary policy. Yet liquidity, retail participation, and regulatory hurdles persist. Reforms by RBI, SEBI, and MoF are promising, and continued internationalisation and risk management can make it a robust driver of long-term growth.

Writer – Vishal Jain

The post Resilient Bonds, Resilient Economy appeared first on The Economic Transcript.