JD Power has released the results of its 2026 U.S. Electric Vehicle Experience (EVX) Ownership Study, an assessment of EV and plug-in hybridowner satisfaction. Focused on the first year of ownership, the study considers not only the car itself, but also factors like public charging availability. The good news is that EV owner satisfaction has reached its best level since the study’s inception six years ago, despite EV market share cooling off in recent months. Tesla put in a strong showing, while EVs from Honda and Audi did not.

Key Study Findings

Nissan

Conducted in collaboration with PlugShare, an EV driver app maker and research firm, the study was based on 5,741 owners of 2025/2026 model-year EVs and plug-in hybrid vehicles. The study evaluates 10 factors of new EV ownership, including the following: accuracy of battery range; public charging availability; interior/exterior styling; safety and technology features; cost of ownership; home-charging convenience; servicing experience; and vehicle quality/reliability.

Impressively, 96% of new EV owners say they’d lease or purchase another EV. Overall premium EV satisfaction reached 786 on a 1,000-point scale, up from 756 last year. For mass-market EVs, this year’s score was 727, up from 725.

These are some other findings from this year’s study:

- Premium EVs saw notable quality improvements, such as reduced squeaks/rattles

- EVs have higher satisfaction ratings than PHEVs

- Public charging availability was the most improved index factor among both premium and mass-market brands, up to 652 for premium models—101 points higher than a year ago

- For mass-market EVs, public charging satisfaction increased to 511, up by 115 points

“EV market share has declined sharply following the discontinuation of the federal tax credit program in September 2025, but that dip belies steadily growing customer satisfaction among owners of new EVs,” said Brent Gruber, executive director of the EV practice at JD Power. “Improvements in battery technology, charging infrastructure and overall vehicle performance have driven customer satisfaction to its highest level ever.”

Related: America’s Fastest EV Chargers Are Coming In 2026, But There’s A Problem

Model and Brand Ratings

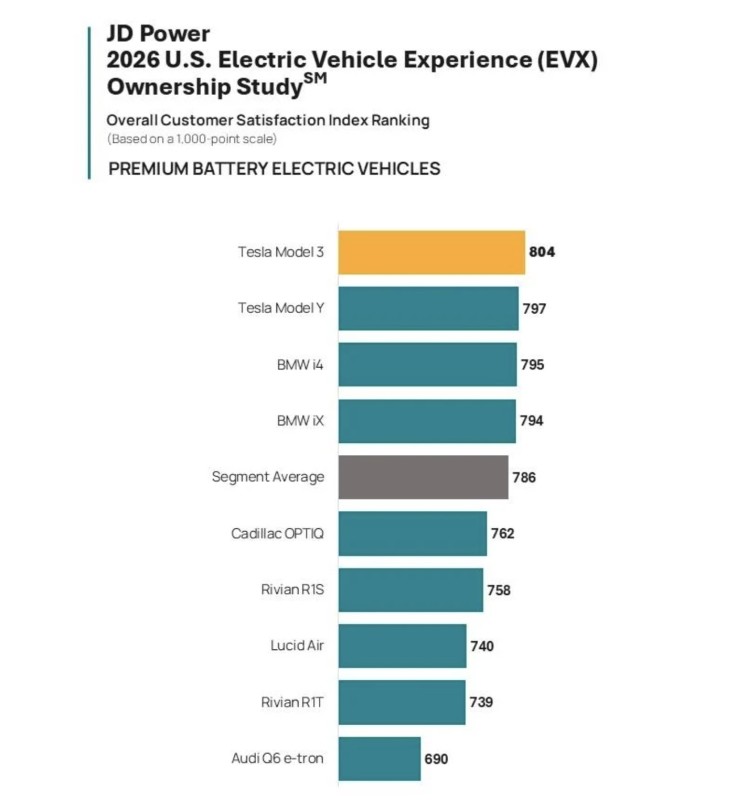

The Tesla Model 3 was the highest-ranked overall model, including in the premium segment. This is likely linked to the availability of a cheaper base model and Tesla’s recent improvements to the electric sedan. It was followed by the Tesla Model Y, BMW i4, and BMW iX. In the mass-market segment, the Ford Mustang Mach-E came out on top, followed by the Hyundai Ioniq 6, Kia EV9, Hyundai Ioniq 5, and Kia EV6.

JD Power 2026 US EVX Ownership Study rankings J

Only two models in the study had scores of under 700 total points. These were the Audi Q6 e-tron (690) and Honda Prologue (623); when we drove the Prologue, its interior and performance left us underwhelmed, and owners may be feeling similarly, based on its score in this study. Perhaps unsurprisingly, the Chevrolet Blazer EV (which shares a platform with the Prologue) also ranked close to the bottom, with a score of 711.

Although JD Power didn’t disclose the specific areas where these low-performing EVs fell short, it’s a disappointing result for a premium brand like Audi, especially given how well close rival BMW performed.

What It Means

EV sales may have suffered after the federal tax credit ended last year, but consumers who have chosen to purchase an electric vehicle are happier with them than they’ve ever been. Many EVs can now cover 300 miles or more on a full charge, while public charger access has improved significantly, removing two of the major pain points for EV ownership.

While plug-in hybrid satisfaction levels have also improved, these remain more complex powertrains, so overall satisfaction isn’t as high as for EVs. Other recent studies point to PHEVs being far less reliable than traditional gas cars.

EV makers have now had several years to refine their offerings, and that’s starting to show in this study. If owner satisfaction keeps improving at this rate, the recent slowdown in demand for electric vehicles may be temporary rather than lasting.