Mark S. Brooks is a venture strategist and corporate innovation leader with deep experience across agtech, biotech, climate, and entrepreneurship. A former academic climate scientist-turned-investor, Mark has deployed over $75 million in venture capital globally, led FMC Ventures, invested at Syngenta Ventures, and founded an agtech startup. While exploring his next senior leadership role, Mark is advising founders, funds, and corporates, and serves part-time as Executive in Residence at the North Carolina Biotechnology Center and Venture Partner at LongLeaf Studios.

The views expressed in this article are the author’s own and do not necessarily represent those of AgFunderNews.

Author’s note: I believe capital, well-placed and well-timed, is the most powerful lever we have to shape

the future. I’m currently exploring senior roles leading corporate innovation, venture investing, or

platform strategy inside science-driven companies.

A quiet reordering of innovation in the global food system is underway.

While much of the noise in agtech has focused on robotics, labor, vertical farms, or the latest biologicals, the most consequential shifts are happening out of view. They’re reshaping who eats what, who owns which assets, what gets funded, and how it’s deployed.

Many still frame the future of ag and food as a question of “how we’ll feed 10 billion people.” That’s too narrow. What’s really at stake is how power, capital, biology, and climate are colliding to reshape an entire system.

This isn’t a yield story. It’s a systems story in which eight trends are already unfolding. These are under-hyped, system-level, and investable, and the most forward-leaning entrepreneurs, investors, and strategics are already moving on them.

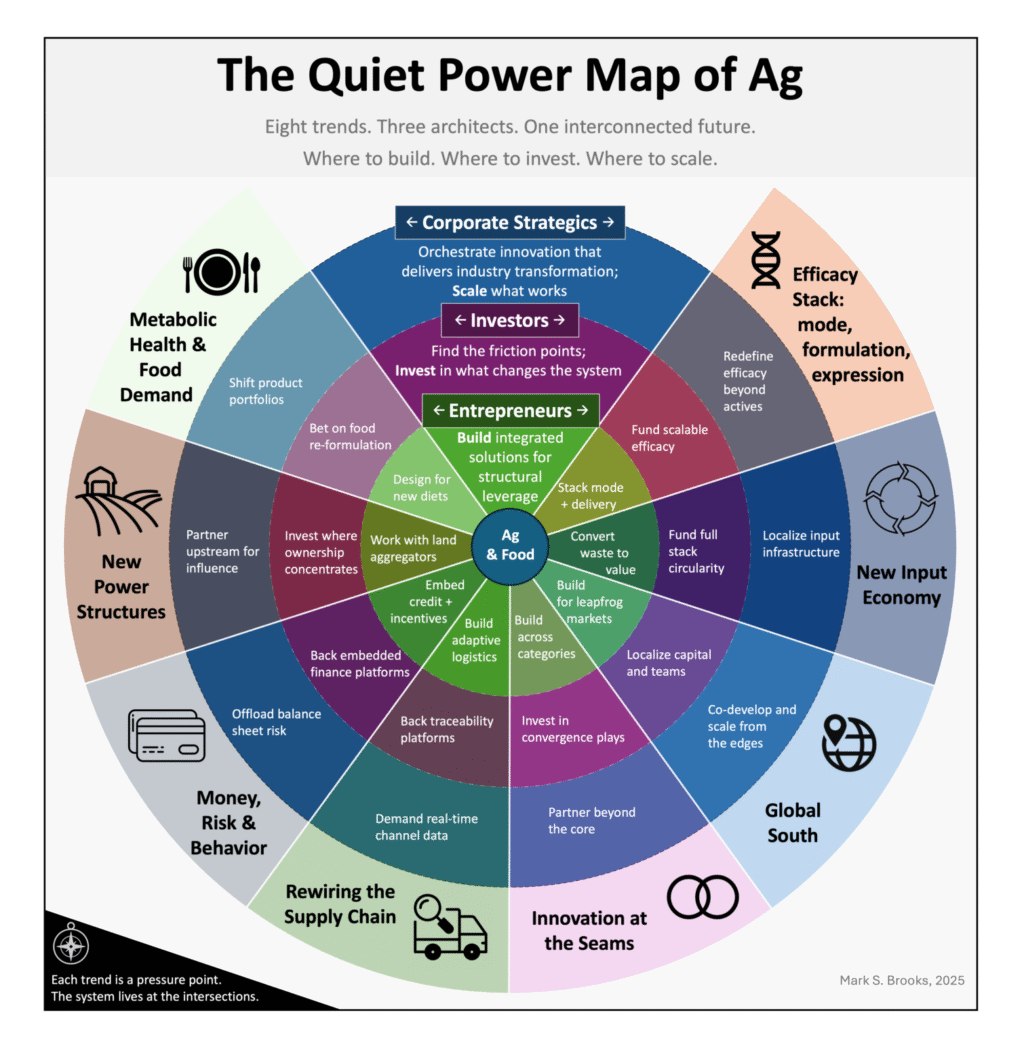

The map above highlights eight emerging trends, each a pressure point reshaping ag innovation. The real leverage lies at the intersections, where entrepreneurs, investors, and corporates can act across these fault lines to drive system-level change.

1. Metabolic health & food demand

Ozempic, Wegovy, and other GLP-1 drugs are changing what people eat, how much they eat, and what the food system must supply.

The implications are enormous: reduced demand for calorie-dense snacks, altered protein consumption, and an eventual rebalancing of commodity crops tied to processed food. Think less corn syrup, more fiber; less snacking, more functional nutrition.

For ag and food entrepreneurs, this is a generational shift in consumption, driven by prescription drugs, with a billion-dollar adoption curve.

2. New power structures in ag

Private equity has quietly become a major force in agriculture, acquiring not just companies, but farmland, retail, and agronomic services. This reshapes control over the farm’s P&L. Where traditional players see yield, PE sees IRR and farmland as an asset class. That changes the game.

Startups that can boost land value, operational efficiency, or cash flow predictability now have a powerful ally. While the grower is still important, this shift may be more about proving value to the land owner.

Distributors are also gaining power. Once low-margin intermediaries, some now act as market-makers, white-labeling startup-developed biologicals and chemistries to boost margins and reduce reliance on majors. This creates a viable go-to-market path for startups and signals a broader shift in who controls product access, pricing, and influence at the farm gate.

These shifts could be the strongest tailwinds agtech adoption has ever seen, but only for startups fluent in financial outcomes. PE firms and distributors may become the new gatekeepers. For strategics and startups alike, this raises the bar for speed and value alignment.

3. Money, risk, and behavior

One of the biggest levers for behavior change is financial. For generations, growers have dealt with supplier credit, tight operating cycles, and opaque pricing. But a wave of fintech innovation is now targeting the ag value chain with tools designed to reduce friction, reprice risk, and unlock liquidity.

From embedded credit and input financing to revenue-based lending and crop-specific insurance, the financial layer is being rebuilt. And when you change how a farmer is financed, you change how they make decisions.

Fintech doesn’t just enable transactions, it rewires decisions. That cover crop, that biological, that precision tool becomes viable not because it’s novel but because it fits into a de-risked financial model.

For founders, partner early with underwriters, co-ops, or lenders. For strategics, continue thinking beyond product and sales; think enablement and financing behavior change.

“Fintech doesn’t just enable transactions, it rewires decisions.”

4. Efficacy stack: mode, formulation, expression

Pests and pathogens in both crops and livestock are developing resistance to legacy treatments. New modes of action are urgently needed like novel biologicals and chemistries in crop systems, and gut health, methane reduction, feed efficiency, and alternatives to antibiotics in animal systems. Regulatory and societal pressure is accelerating the urgency.

Yet many biological and microbial solutions still fail in the real world because they don’t meet or surpass pricing hurdles, application stability, or efficacy alone. This is where efficacy becomes a system, not a single breakthrough. In some cases, a breakthrough bio-control product is only viable when paired with a breakthrough delivery system like encapsulation or microbial consortia.

Now, an additional layer is emerging: trait expression modulation. Epigenetics, environmental triggers, and microbial partnerships are giving innovators new ways to fine-tune how traits perform under stress or across environments, without rewriting the genome itself.

For investors and strategics, the lesson is clear: the winners won’t just be discovering new peptides or strains. They’ll build full-stack platforms that integrate active ingredients, formulation, delivery, and expression into one cohesive performance engine.

5. Channel efficiency is now existential

The 2021–2024 boom-bust cycle in ag inputs wasn’t a one-off. It was a symptom of poor visibility across supply chains, especially in crop inputs, resulting in massive misalignment. When manufacturing slowed due to COVID-19, distributors responded with aggressive forward-buying to protect supply. That pushed record sales by the ag majors and record volumes into warehouses, leading to artificial spikes in revenue and inventory hangovers a year later. This represents a systemic failure of channel forecasting, coordination, and digital infrastructure.

The opportunity now lies in digitizing and integrating supply chain systems to enable real-time forecasting, inventory management, and risk mitigation. What used to be “nice-to-have” ESG features like traceability are now being reframed as tools for financial and operational resilience.

Visibility tech, demand sensing, and adaptive logistics are now board-level issues. More than data problems, they’re capital flow and margin management challenges. Winning products may not be the best tech, but those that move most efficiently through the channel.

6. Rise of the global south

Most ag innovation has historically flowed to the Global South, from labs and corporates in the Global North to farmers in Latin America, Africa, and South Asia. That model is breaking.

These regions are now becoming epicenters of innovation themselves. Climate variability, fragmented supply chains, and digital leapfrogging are combining to make these markets more willing to adopt, adapt, and iterate than many mature economies. Think: mobile-first agronomy, embedded finance, localized biologicals, decentralized cold chains. Innovation here isn’t built for perfection, but rather for survival. That constraint breeds creativity.

For entrepreneurs and investors, the takeaway is simple: don’t just export solutions. Go build in-market. Co-develop with local players. Back teams from these regions. For strategics, these regions represent not just growth markets but testbeds for adaptable, high-velocity innovation. Because in many ways, the Global South isn’t catching up but rather skipping ahead.

7. Circular inputs are coming into focus

For decades, the ag input model was linear: extract, synthesize, distribute, apply. But rising input costs, supply chain volatility, and environmental scrutiny are pushing the need for something more circular and resilient.

Early momentum is being recognized around recycled phosphorus, biochar, wastewater reuse, and on-farm nutrient loops. More than climate plays, these are about cost stability, input independence, and new margin opportunities.

For entrepreneurs, the challenge is matching innovation with infrastructure: decentralized systems, mobile processing units, modular or on-farm biomanufacturing. For strategics, it’s about rethinking supply chains for circularity, verification, and resilience.

“The best innovations won’t fit neatly in agtech. And that’s exactly the point.”

8. Innovation at the seams

Agtech intersects with adjacent systems—energy, textiles, water, health—forming new categories that don’t yet have names, let alone market leaders.

Ag waste could become feedstock for bio-based plastics. Crops could be engineered for the production of pharma compounds. Microbials could be engineered to complement metals-based energy storage.

Regenerative practices intersect with carbon markets. Even cotton production is now in the sights of climate financiers.

These seams, where sectors overlap, are where old assumptions break down and new value gets created. They also require a different kind of builder: one fluent in ag, but also in energy systems, supply chains, fashion, and fintech.

For investors and strategics, the playbook is no longer sector-specific. It’s adjacency-specific. The best innovations won’t fit neatly in agtech. And that’s exactly the point.

Signals to watch: what we didn’t cover (yet)

These dynamics aren’t fully formed, but they’re early fault lines for what comes next.

AI and LLMs: From biological discovery platforms to agronomic decision support, AI is beginning to unlock speed, scale, and pattern recognition that humans can’t. Large language models will increasingly guide ag decisions, bridge R&D to go-to-market, and surface hidden signals across genetics, field data, and markets.

Eventually, nobody will ask whether you’re using AI, just like nobody asks if you use email.

AI will touch every trend mentioned here.

The Shrinking Middle Layer: A collapse in Series B/C funding and a slowdown in corporate venturing, has created a capital gap. Many startups are stuck, too capital-intensive for seed funds, too early for growth equity.

This has sparked a debate about whether traditional VC is a fit for agtech. The skepticism isn’t wrong; timelines are long, adoption is hard, exits are rare. But this isn’t a dismissal, it’s a challenge.

The next wave won’t be won by capital that moves fast; it’ll be won by capital that knows where and how to press.

“These trends don’t shout. But they quietly reroute where capital flows, adoption sticks, exits emerge, and market power gets built.”

The view from the quiet edge

Ag innovation is shifting toward the friction points where systems collide: capital, asset ownership, diet, climate instability, supply chains, and cross-sector adjacencies.

These trends don’t shout. But they quietly reroute where capital flows, adoption sticks, exits emerge, and market power gets built.

For entrepreneurs, this is a call to build systems, not just products.

For investors, a reminder to look beyond the pitch, towards real structural leverage.

For corporates, it’s no longer about what you’re investing in, but where and why. The next edge is orchestration—that is, partnering, acquiring, and investing where the real friction lies.

The next decade of ag innovation won’t be defined by who produces the most. It will be defined by who reshapes the game before others catch on.

The post The quiet trends reshaping ag: a field guide for builders, backers, and business leaders appeared first on AgFunderNews.