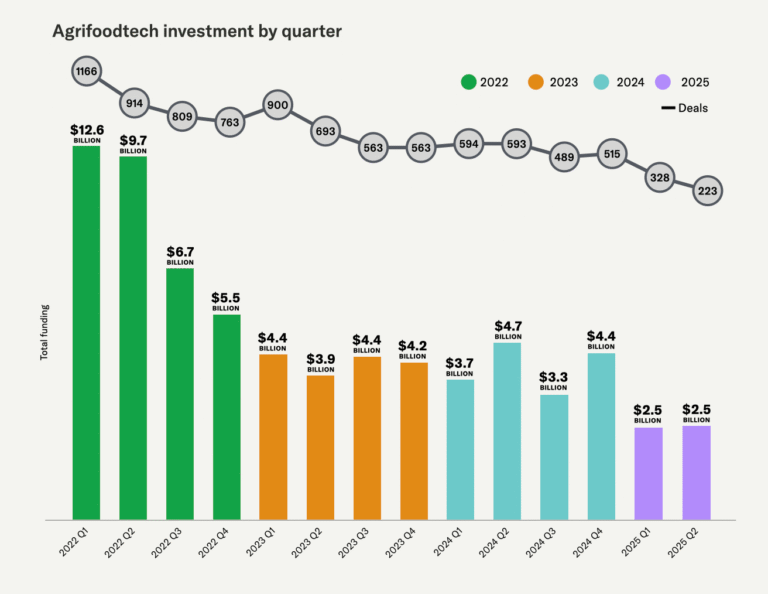

As recently released mid-year agrifoodtech investment numbers can attest, there’s still a venture capital dearth in the space. The question now is, where should agtech startups look for funding now that VC dollars are flowing less freely?

A group of agtech industry players discussed this at length last week during a panel at the Salinas Biological Summit in California, covering multiple ideas for accessing funding while also issuing a few stern reality checks.

“You need to know where your money is coming from,” said Dave Kochbeck, former chief scientist at Silicon Valley Bank.

“Venture capitalists aren’t investing venture capitalist money, they’re investing other people’s money, and the other people are in a different state than they were three, five, or 10 years ago. The realities of venture capital are very, very different than they were before.”

He went as far as to suggest what patient capital is left in the system is dwindling. Layer the rise of AI technologies on this, and “the expectation to go faster is going to increase more and more and more.”

“I don’t think the [agrifoodtech] world has come to the conclusion yet that venture capital is not about risk capital or being patient. It’s about accelerating the process so that you can harvest the outcome in the next 10 years.”

“There’s going to be this big shift where those timescales are going to get shorter,” he added. “And the question, how are you de risking this while at the same time, going three or four times faster, is going to become like a real topic for the industry.

‘You can’t just be incrementally better’

Agrifoodtech investment dollars are tough to come by for agtech startups right now, said panelists, particularly when it comes to venture capital. They’re out there, to be sure, but only for those with “the right story to tell.”

“You can’t just be incrementally better,” said Jackson Morrow, vice president of climate tech at JP Morgan. “You have to be a step-change better than what’s out there, and you have to be able to generate that kind of a VC return, otherwise VC is not necessarily the best source of capital.”

This is something Pam Marrone, founder and chair of the Invasive Species Corporation, has repeatedly stressed in the ag biologicals world, and noted again at this year’s Salinas Biological Summit. Companies have to differentiate from what’s already available to growers, who are often happy to reinvest in tools they know but reticent to bet the farm on an unproven offering.

This is where storytelling—aka marketing—could play a role, and according to Danny Bernstein, CEO of ag robotics incubator The Reservoir, agtech has not done a stellar job so far in marketing itself.

“The best marketers I’ve met in my career have been ex-Unilever, ex-P&G, etc. But we don’t have those folks [in agtech], so we have a really significant marketing challenge,” he said.

The same is true for investor relations: “We’re very deep tech driven, we’re very science driven, but we’re drastically under-resourcing the fundamental ways that we’re actually going to be engaging the investor community in mainstream way.”

The role of accelerators for early-stage startups

It’s widely acknowledged now that generalist investors have left the agrifoodtech investment space following the disappointing performance of sectors like vertical farming and alternative proteins.

They’re unlikely to return until agtech can generate a few more strong exits, said Morrow, which means the VC dearth is set to last for the foreseeable future.

One solution for startups to consider is accelerators and incubators.

The Reservoir, of course, is a case in point. It will launch its incubator in Salinas, California in August to, as Bernstein has said, “bridge the gap between deeptech R&D and commercial deployment.”

Part early-stage VC, part robotics studio, and part incubator program, it will aim to help startups test and validate their products and get them to market.

“There aren’t those early-stage [funding] sources anymore,” he said during the panel. “So we have to figure out, at a global scale, how are we competing for the best talent? How are we bringing those entrepreneurs in? That’s what The Reservoir is trying to do.”

“Those [programs] are great early partners for companies that are trying to get a little bit of validation from third parties,” said Morrow, who highlighted Activate and IndieBio programs as other notable examples.

“You want to find the right investors early on, and oftentimes those are going to be angel investors who have a personal interest in the space or family offices that understand the importance of ag solutions.”

These early-stage partners, he adds, are who the larger VCs will look to when they are building their pipelines for deals.

The post The realities of agrifoodtech investment in 2025: ‘Venture capital is not about being patient’ appeared first on AgFunderNews.