Toyota extended its winning streak in August 2025, with global sales climbing 2.2% year-over-year to 844,963 vehicles. That marks the company’s eighth consecutive month of growth, highlighting the brand’s resilience amid shifting global demand.

The United States carried much of that weight. Sales there jumped 13.6%, fueled by sustained demand for hybrids and a strong appetite for SUVs. In contrast, Toyota’s domestic market in Japan saw sales plunge 12.1%, reflecting weak consumer sentiment and an already saturated marketplace. Despite this decline, the company’s global production rose 4.9%, its third consecutive monthly increase, as supply chains stabilize and inventories improve.

Why the U.S. Matters More Than Ever

Toyota’s latest results make it clear that the American market is its growth engine. Models like the RAV4, which just gained a new affordable September lease deal, are among the brand’s strongest sellers and continue to attract buyers seeking practicality and efficiency.

Crossovers remain a sweet spot. The Corolla Cross and RAV4 are now sold side-by-side, appealing to different budgets and lifestyles. As a recent comparison shows, the 2026 Corolla Cross and 2026 RAV4 differ in five major ways, from size and features to performance. Both, however, illustrate Toyota’s dominance in the entry-to-mid SUV segment.

Even the 2026 Toyota Crown, with its more premium positioning, is now available with an intriguing lease package for September, signaling how Toyota is broadening its appeal beyond traditional family haulers.

Challenges at Home and Abroad

The picture looks different in Japan, where sales have cooled significantly. Analysts point to a stagnant economy, slowing replacement cycles, and competition from cheaper domestic EVs as reasons why Toyota’s dominance is under pressure at home.

Globally, Toyota is also facing tariff headwinds and heightened EV competition from Chinese manufacturers, forcing the company to tread carefully with its electrification strategy. Toyota continues to focus on hybrids as its bridge technology, which has helped it maintain profitability where rivals chasing full EV rollouts have struggled.

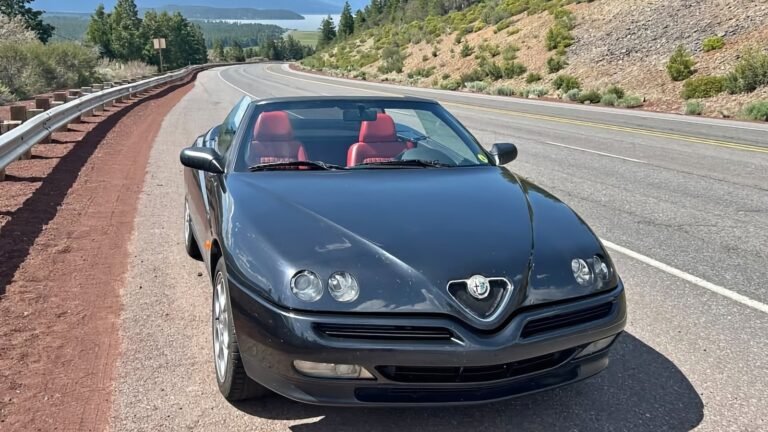

Getty Images

Why This Matters Going Forward

Toyota’s eighth straight month of growth is proof of the company’s adaptability. By leaning on its U.S. strength and hybrid portfolio, it has balanced out domestic weakness and global volatility. However, questions remain about how sustainable this trajectory is. Will Toyota be able to maintain sales once U.S. incentives shift or consumer sentiment cools? And can it balance its hybrid-first strategy with increasing regulatory pressure to accelerate EV adoption?

For now, Toyota is doing what it does best, playing the long game. With flexible product strategies, a deep crossover lineup, and creative lease deals designed to keep cars moving off lots, the world’s largest automaker continues to find ways to stay ahead in a market that remains anything but predictable.