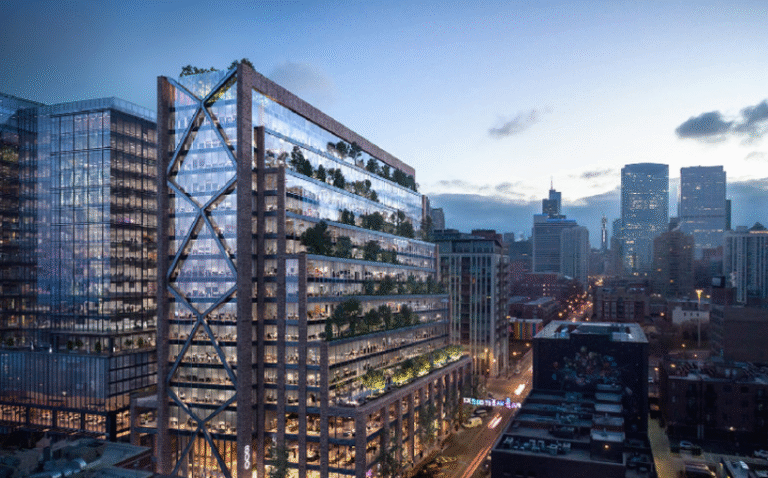

Office space conversions to other uses have long been touted as a solution to make use of empty space. Now it seems as though there is information that such transitions are doing some good.

A recent report by CBRE—“Conversions & Demolitions Reducing U.S. Office Supply”—indicated that pull-downs and adaptations are on pace to exceed new office space deliveries in 2025 and are “helping to erode record-high availability and support the U.S. office market’s recovery.”

CBRE analysts tracked 58 markets, noting that 23.3 million square feet of office space is planned for conversion to other uses (12.8 million square feet) or demolition (10.5 million square feet). Meanwhile, 12.7 million square feet of new office supply is anticipated to be delivered.

The write-up explained that the conversion/demolition trend gained momentum over the past decade and has accelerated since the pandemic. What are the plans for the space? According to the report:

- 76% is slated for multifamily uses

- 8% is being used for hospitality

- 4% is being converted for industrial functions

- 3% is being considered for life science purposes

The write-up also said that conversion activity varies by market because of building values, inventory age, construction costs and experienced developer availability.

Amid the positive news about office conversions, the write-up warned that not all buildings can be converted. Facilities constructed in the 1970s and 1980s that have large floor plates “account for more than half of the demolitions and only 35% of conversions,” the report said.

Additionally, conversions could be impacted by persistent high interest rates, increased construction costs and scarce labor. “As a result, many developers will likely wait for a more favorable economic environment to move forward with their plans,” the CBRE analysts said.

The post U.S. Office Inventory Declines, Thanks to Conversions and Demolitions appeared first on Connect CRE.