If you’re looking to grow your wealth through automated investing, two platforms stand out: Wealthfront and M1 Finance. Both offer low-cost, hands-off investment solutions, but they cater to different types of investors. In this guide, we’ll break down their features, fees, and ideal use cases to help you choose the best investment platform for your financial goals.

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Quick Comparison: Wealthfront vs M1 Finance

Both Wealthfront and M1 Finance deliver automated investing solutions plus self-directed investing. But, there’s more to each platform than meets the eye. Read on to find out which one will fit your investing style.

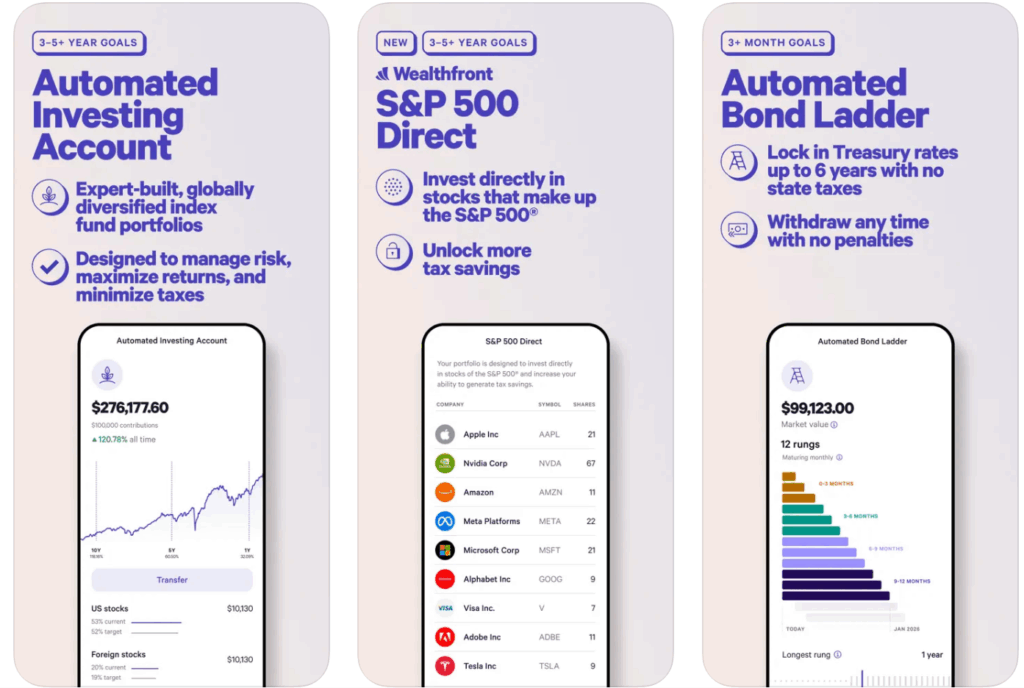

Wealthfront: Robo-Advisor Plus More

What is Wealthfront? Wealthfront began as a classic robo-advisor designed for investors who want a fully automated experience. After a quick quiz, Wealthfront offers a diversified investment portfolio, in line with your timeline, risk level and goals. This robo-advisor arm of Wealthfront handles rebalancing, dividend reinvestment, and even tax-loss harvesting to optimize your returns.

There’s more > Wealthfront also has individual stocks, ETFs and themed portfolio investing,

- Automated investing with low fees (0.25% annually).

- Tax-efficient strategies, including direct indexing for high-net-worth clients.

- Socially responsible portfolios available.

- Individual stocks, ETFs and themed portfolios great for self-directed investors.

- Bond ladders for the fixed income segment of your portfolio.

- Wealthfront Cash Account is a High-yield cash account that combines checking and savings features.

Wealthfront is ideal for long-term investors who prefer a “set it and forget it” approach. - Portfolio line of credit and home mortgages are coming soon!

Free investing at M1 with $10,000 balance or loan, otherwise $3/month.

M1 Finance: Self-Directed Investing Plus Automated Solutions

What is M1 Finance? M1 Finance delivers 1,000’s of ETFs and stocks along with screeners to help you design your ideal portfolio. The M1 expert model portfolios are designed to cater to a variety of investment preferences, including retirement, stock and bond, income, global, socially responsible, aggressive and conservative choices. Whichever types of investment portfolios you choose, the platform will rebalance it back to your preferred asset allocation, upon request.

- Three dollars per month to zero account fees for those with a $10,000 account balance, or a personal loan.

- Customizable portfolios with fractional shares.

- Integrated banking and high-yield cash account.

- Margin loans available for accounts with $2,000+ invested.

Wealthfront vs. M1 Finance Comparison Chart

Wealthfront vs. M1 Finance Comparison Chart

| Feature | Wealthfront | M1 Finance |

|---|---|---|

| Core Focus | Automated investing with optional self-directed tools. | Self-directed investing with automated rebalancing. |

| Portfolio Setup | Quiz-based, goal-aligned diversified portfolios. | DIY portfolios using stocks & ETFs or model portfolios. |

| Investment Options | Broadly diversified stock and bond portfolios plus Individual stocks, ETFs, themed portfolios. | 1,000s of ETFs & stocks, fractional shares. Scores of M1 Model portfolios. |

| Automation Features | Rebalancing, dividend reinvestment, tax-loss harvesting. | Rebalancing upon request. |

| Tax Efficiency | Tax-loss harvesting and direct indexing for high-net-worth clients. | Not emphasized. |

| Socially Responsible Portfolios | Available. | Available. |

| Fixed Income | Bond ladders and bonds are included in automated portfolios and ETFS. | Included in model portfolios and ETFs. |

| Cash Management | High-yield cash account (Wealthfront Savings Account) with checking/savings features. | High-yield cash account with integrated banking features. |

| Fees | 0.25% annual advisory fee. No commissions or management fees for stock and ETF portfolios.1 | $3/month or $0 with $10K balance or loan.2 |

| Margin Loans | Portfolio line of credit available for accounts with $25,000+. | Available for accounts with $2,000+. |

| Ideal For | Long-term, hands-off investors. | DIY investors who want automation and flexibility. |

Commission-Free investing at M1 with $10,000 balance or loan, otherwise $3/month.

Wealthfront vs M1 Finance Review – Which One is Best for You?

Whether you’re just starting out or optimizing an existing portfolio, Wealthfront and M1 Finance offer compelling solutions.

Choose Wealthfront if you want a fully managed, tax-efficient portfolio with minimal effort, and stocks and ETFs.

Choose M1 Finance if you want to build your own portfolio, choose a model portfolio and opt for rebalancing.

Both platforms are excellent, but your choice depends on how hands-on you want to be with your investment management. Wealthfront shines with its tax strategies and simplicity, while M1 Finance empowers investors with customization and integrated financial tools

Wealthfront is ideal for passive investors who want everything managed, while M1 suits DIY investors who want control with some automation. Both offer cash management and socially responsible investing options.

M1 Finance is perfect for investors who want control over their portfolio but still appreciate automation.

FAQ

Yes, Wealthfront is committed to maintaining a high level of safety and security. Wealthfront uses bank-level security and carries insurance through partner banks for cash deposits with the FDIC and company bankruptcy with the SIPC. While investing always carries market risk and price volatility, Wealthfront’s automated strategies aim to reduce volatility through diversification and features like tax-loss harvesting.

Yes, M1 Finance is considered safe for investors. It’s a registered broker-dealer with the S EC and cash deposits are protected through partner banks with the FDIC. While investment assets are protected from corporate bankruptcy and malfeasance by the SIPC, market

investments always carry risk. M1’s infrastructure and regulatory compliance help safeguard your assets and personal data.

Related

- Pros And Cons Of M1 Finance

- Best M1 Finance Pies

- Checkbook IRA – Ultimate Guide To A Self-Directed IRA

- The Secret to Flawless Investment Management – For FREE

- How Can Investors Receive Compounding Returns?

Sources:

1 https://support.wealthfront.com/hc/en-us/articles/13992378758676-Understanding-Wealthfront-fees

- Automated Index Investing Accounts: Annual advisory fee of 0.25%

- Automated Bond Portfolio: Annual advisory fee of 0.25%

- Automated Bond Ladder: Annual advisory fee of 0.15%

- S&P 500 Direct Portfolio: Annual advisory fee of 0.09%

- Stock Investing Account: Free. Wealthfront does not charge clients any fees, including account fees or commissions

2 https://m1.com/legal/disclosures/platform-fee-disclosure/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

M1 Disclosure: This content is not a solicitation, is not endorsed by M1, and was not reviewed by M1; the opinions expressed are solely those of the authors and do not reflect M1’s views. Information presented is accurate as of the video posting date; for the most up-to-date information, please refer to m1.com. Before making any investment decisions, consult your personal investment, legal, and tax advisors, as this content is for informational purposes only and not intended as investment recommendations.

I have a funded account M1 Finance.

The post Wealthfront vs M1 Finance: Pros, Cons & Which Is Best for You appeared first on Barbara Friedberg.