Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

A recent Zillow analysis suggests it would take a drop of more than one percentage point—to 4.43%—for the median-income U.S. homebuyer to comfortably afford the median-priced U.S. home. And that assumes a 20% down payment, which many first-time buyers are unable to make.

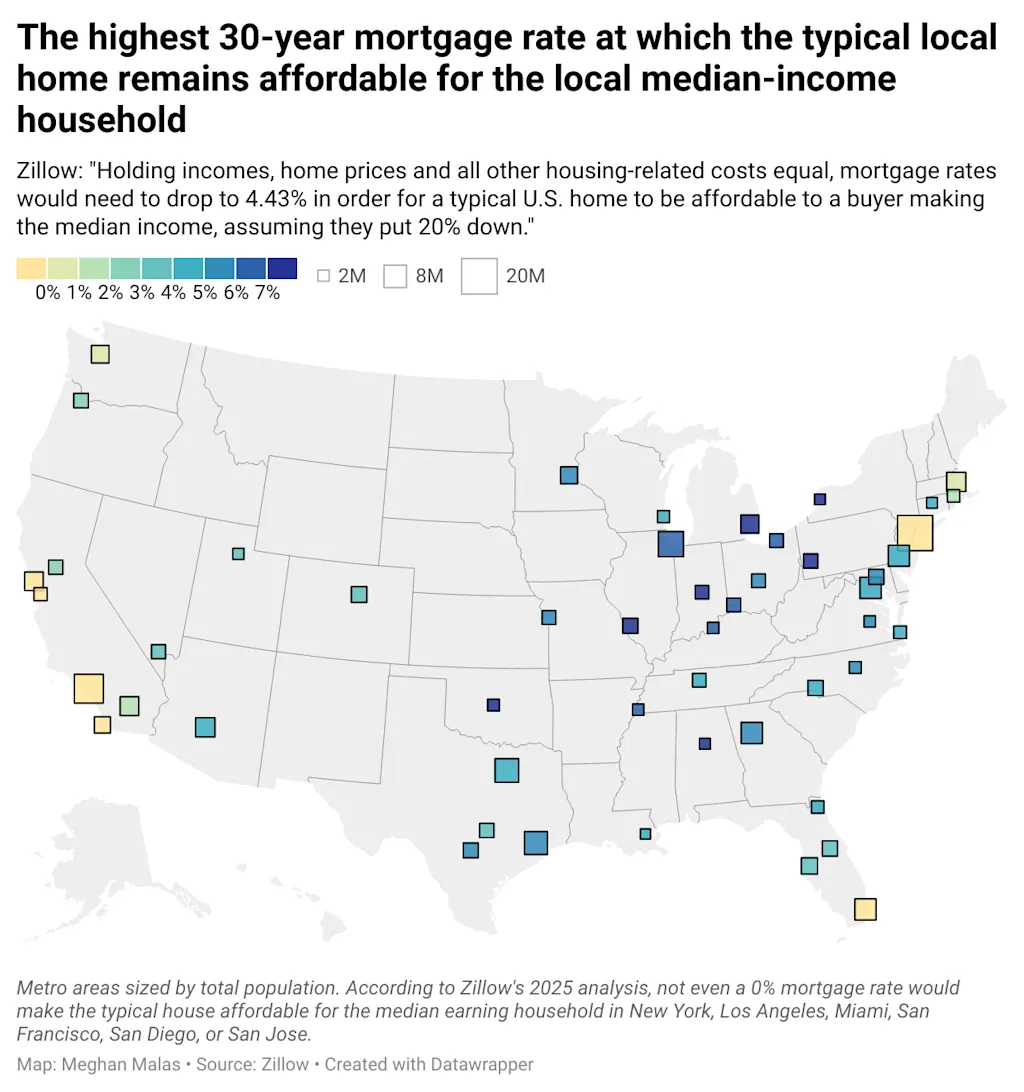

Even more striking, in several high-cost coastal metros, not even a 0% mortgage rate would make the median-priced local home affordable for a household earning the local median income. This includes New York, Los Angeles, Miami, San Francisco, San Diego, and San Jose, where taxes, insurance, and maintenance on a median-priced home alone can often consume more than 10% of a median household’s income.

On the flip side, Zillow finds that mortgage rates are already low enough for median-income buyers in many Midwestern markets to afford the median-priced home in those areas.

Keep in mind, this is back-of-the-envelope math. The mortgage rate scenarios above assume all else is equal—and that lower rates don’t impact home prices.

Are we likely to see an average 30-year fixed mortgage rate of 4.43% anytime soon? Zillow economists say that scenario is “unrealistic”—at least in the short term.

“Holding incomes, [U.S.] home prices and all other housing-related costs equal, mortgage rates would need to drop to 4.43% in order for a typical home to be affordable to a buyer making the median income, assuming they put 20% down. That kind of a rate decline is currently unrealistic,” wrote Zillow economic analyst Anushna Prakash.

Prakash added that: “If buyers are waiting for big drops in mortgage rates or [U.S. home] prices to help affordability, they’re in for a rude awakening. Just like falling rates, that kind of correction in house prices won’t happen without a serious slowdown in economic growth and income growth, and a rise in the unemployment rate.”